Newspaper Headline: Secure Ecommerce Tokenization Methods Unveiled

Share

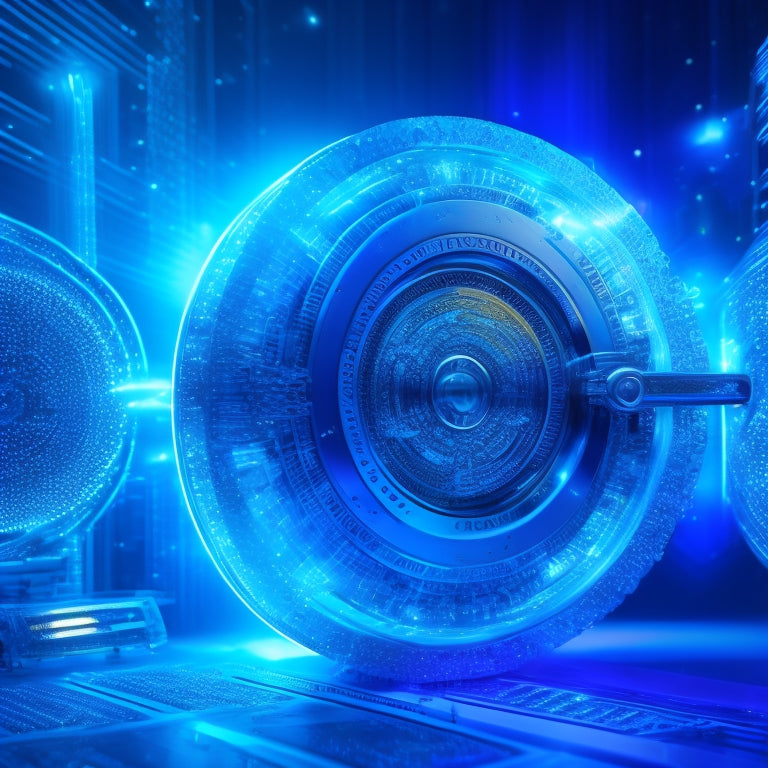

Ecommerce businesses can greatly reduce the risk of handling and storing sensitive payment card data by implementing secure tokenization methods, which substitute sensitive credit card information with unique tokens. This approach offers benefits like reduced liability, simplified compliance, and enhanced customer trust. However, it may have drawbacks such as increased complexity and potential interoperability issues. To guarantee effective tokenization, merchants should consider implementing robust security protocols, client-side tokenization, and utilizing a reliable tokenization provider. By exploring the various types of payment tokenization and their trade-offs, businesses can select the approach that best aligns with their security requirements and business needs, and discover a more secure payment processing landscape.

Key Takeaways

• Secure ecommerce tokenization methods reduce risk of handling and storing sensitive credit card information, enhancing customer trust and simplifying compliance.

• Implementing robust security protocols, client-side tokenization, and utilizing a reliable tokenization provider are essential best practices for ecommerce tokenization.

• Three primary tokenization approaches – merchant, acquirer, and network tokenization – offer unique benefits, with acquirer tokenization providing an additional layer of security.

• Merchants should carefully evaluate trade-offs between tokenization methods, selecting the approach that best aligns with business needs and security requirements.

• Adherence to industry standards like PCI-DSS is crucial when implementing tokenization solutions to protect customers' financial information.

Understanding Tokenization Methods

Tokenization methods, a cornerstone of ecommerce security, substitute sensitive credit card information with unique tokens, thereby reducing the risk of handling and storing sensitive data. This approach offers several benefits, including reduced liability, simplified compliance, and enhanced customer trust.

However, tokenization is not without its drawbacks, such as increased complexity and potential interoperability issues. To maximize the benefits of tokenization, best practices include implementing robust security protocols, ensuring tokenization is performed client-side, and utilizing a reliable tokenization provider.

Additionally, merchants should carefully evaluate the trade-offs between different tokenization methods and select the approach that best aligns with their business needs and security requirements. By adopting tokenization best practices, ecommerce merchants can effectively mitigate the risks associated with handling sensitive payment data.

Types of Payment Tokenization

In the domain of payment card security, three primary approaches to tokenization have emerged: merchant, acquirer, and network tokenization, each with its unique characteristics and benefits.

Merchant tokenization involves securely storing card numbers and assigning tokens, offering merchants control over their customers' data.

Acquirer tokenization, on the other hand, stores card numbers in a vault on behalf of merchants, providing an additional layer of security.

Network tokenization, provided by major card issuers, replaces primary account numbers with unique payment tokens, offering benefits such as increased security and convenience.

A comparison analysis of merchant vs. acquirer tokenization reveals that acquirer tokenization provides greater security, while merchant tokenization offers more control.

Network tokenization, although secure, may have drawbacks such as limited compatibility and restricted use cases.

Implementing Secure Tokenization

To mitigate the risks associated with handling sensitive payment card data, ecommerce businesses must carefully consider the implementation of secure tokenization methods that guarantee the protection of customers' financial information.

Effective tokenization implementation involves adhering to best practices that prioritize data security. This includes adopting tokenization strategies that ensure sensitive data is substituted with unique tokens, making it unreadable to unauthorized parties.

Implementing tokenization solutions that follow industry standards, such as PCI-DSS, is essential. Additionally, ecommerce businesses should make sure tokenization solutions are integrated with their existing infrastructure, providing seamless and secure payment processing.

Frequently Asked Questions

What Happens if a Customer Disputes a Transaction With a Tokenized Card?

In the event of a disputed transaction with a tokenized card, the merchant can facilitate dispute resolution by providing the tokenized card information, ensuring customer protection through secure and compliant processes.

Can Tokenized Cards Be Used for Recurring Subscription Payments?

Can tokenized cards be restricted to one-time payments only? No, tokenized cards can be used for recurring subscription payments, enabling auto-renewal and flexible billing cycles, as multi-pay tokens can be stored and reused for subsequent transactions.

How Do I Handle Token Expiration for Stored Payment Cards?

To handle token expiration for stored payment cards, implement a Card Expiration management system, which updates tokenized card information upon expiry, ensuring seamless recurring transactions and minimizing failed payments due to outdated card details.

Are Tokenized Cards Compatible With 3D Secure Payment Protocols?

Like a shield of protection, tokenized cards seamlessly integrate with 3D Secure payment protocols, ensuring adherence to stringent Security Standards, while Payment Gateways like Clover facilitate secure transactions, bolstering the fortress of ecommerce security.

Can I Use Tokenized Cards for Refunds or Chargebacks?

Tokenized cards can be used for refunds and chargebacks, but with card limitations; token security guarantees secure processing, as original card data is not exposed, allowing for seamless and secure transaction reversals and adjustments.

Related Posts

-

Enhancing Online Shopping: Introducing Vimotia's Shoppable Video Experience

Vimotia Shoppable Videos UGC is a cutting-edge app that revolutionizes the online shopping experience by introducing ...

-

Which Sales Channel Is Best for Shopify

This article aims to provide an objective analysis of the various sales channels available for Shopify. It explores ...

-

Expand Your Shopify Store With Top Sales Channel Apps

The integration of sales channel apps into the Shopify platform offers an opportunity for businesses to expand their...